Starting on October 1, Missourians will be able to shop for health insurance through a new online marketplace. It’s one of the biggest changes in health insurance coverage under the federal Affordable Care Act.

But there’s still a lot of confusion about how the exchanges will work.

St. Louis Public Radio's Véronique LaCapra spoke with the Missouri Foundation for Health’s Ryan Barker to try to get some answers.

How will Missourians access the new health insurance options?

Barker: Missouri is one of 27 states that has a federally-run exchange, so it will be private health insurance in the market, overseen by the federal government. So we will actually go to healthcare.gov to enter the marketplace.

What about across the river in Illinois?

Barker: Now they’re a little different, in that they have a partnership marketplace, which means the state is working closely with the federal government to establish that marketplace.

Eventually they have said they want to take it over, and it will be a state-based marketplace, but for now you also will go to healthcare.gov and just pick Illinois.

More info we dug up: Starting on October 1, the simplest way for Illinoisans to access their state's health insurance marketplace will be at getcoveredillinois.gov.

Now, does this mean that everyone is going to have to buy health insurance starting October 1?

Barker: There is the individual mandate which is in effect come 2014. So the marketplace is open for enrollment from October 1 through March 31 of next year. If you buy health insurance on the marketplace by December 15, your insurance plan will start on January 1.

Now if you decide not to buy insurance, then there is a penalty or fine that will start in 2014. It starts out pretty minimal, and then does increase year after year after year.

More info we dug up: Not everyone will have to pay a penalty. For example, you are exempt if you:

- Are below the income threshold for filing a tax return ($10,000 for an individual, $20,000 for a family in 2013);

- Would have to pay more than 8% of your income on health insurance, after taking into account employer contributions or tax credits;

- Are a member of a federally-recognized Indian Tribe;

- Are a member of certain religious sects;

- Are incarcerated.

Also, you will not have to pay a penalty if you would have qualified for Medicaid under the Affordable Care Act, but your state (like Missouri) opted not to expand the program.

If you do decide to buy insurance, do you have to do it through this new marketplace?

Barker: No. So the marketplace is one option. But most consumers that get their insurance through their employer, that will remain the same. So if you have employer-sponsored insurance, you don’t have to do anything.

More info we dug up: If the health insurance premium offered by your employer costs more than 9.5 percent of your household income, or if your employer's plan pays less than 60 percent of the cost of covered benefits, then you can opt out of employer coverage and go to an exchange for health insurance.

And what about seniors? I know there’s been some confusion as to whether this is going to affect people who are currently enrolled in Medicare.

Barker: Seniors have to do absolutely nothing. So if you have Medicare, you’re currently enrolled, there’s really nothing in the marketplace that concerns you. The Affordable Care Act itself strengthened Medicare in some ways, closed the Part D donut hole, but in terms of the marketplace seniors don’t need to worry about doing anything.

All right, so who is going to take advantage of this new marketplace, or who stands to benefit from it?

Barker: In Missouri we have about 900,000* uninsured Missourians. We expect a large number of those uninsured Missourians are eligible for tax credits and subsidies in the marketplace, and so it’s a good place for them to go shop for insurance and find affordable insurance.

We also expect that there’s quite a few families that don’t get insurance through their employer that are currently buying insurance outside, in the open market, and they will also be eligible to go to the Marketplace and check it out.

*More info we dug up: Although estimates vary, a recent census report put the number of Missouri's uninsured at just under 800,000.

Is there anybody who is NOT going to be able to get insurance through the new marketplace? I’m thinking, for example, maybe, people with pre-existing conditions, or something like that.

Barker: No, in terms of that type of – age, or preexisting conditions, none of that will disqualify people.

The only people specifically excluded from the marketplace are undocumented workers. They are actually barred from the marketplace. Other than that, the marketplace is open to most people.

And are there some people who are going to have to pay more?

Barker: There is a range of incomes that will make you eligible for tax credits or subsidies in the marketplace. If you don’t fit in within those income ranges you may have to pay full price.

The only thing that insurance companies can really charge people more or less on ― there’s a couple of categories. So one is age. They can charge differently based on age, but it’s limited to 3-to-1. So a 62-year-old compared to a 22-year-old could pay three times as much as that younger person.

So, age, family size. A family of four would pay more than a family of two. And then smoking. So if you are a tobacco user, you pay one-and-a-half-times as much as a non-smoker.

More info we dug up: Households with incomes that fall between 100 percent and 400 percent of federal poverty levels will qualify for an Advance Premium Tax Credit. Those with incomes between 100 and 250 percent of poverty may also qualify for lower out-of-pocket costs, like deductibles and co-pays.

Individuals making LESS than the federal poverty level DO NOT qualify for a tax credit in the health insurance marketplace, because they are eligible for coverage under Medicaid expansion. But if you are in a state (like Missouri) that opted not to expand Medicaid, you will have to pay full price for coverage in the marketplace.

In St. Louis City and County, you can enroll in the Gateway To Better Health Program, which provides primary, specialty and urgent care coverage to uninsured adults (ages 19-64) through a network of community health centers.

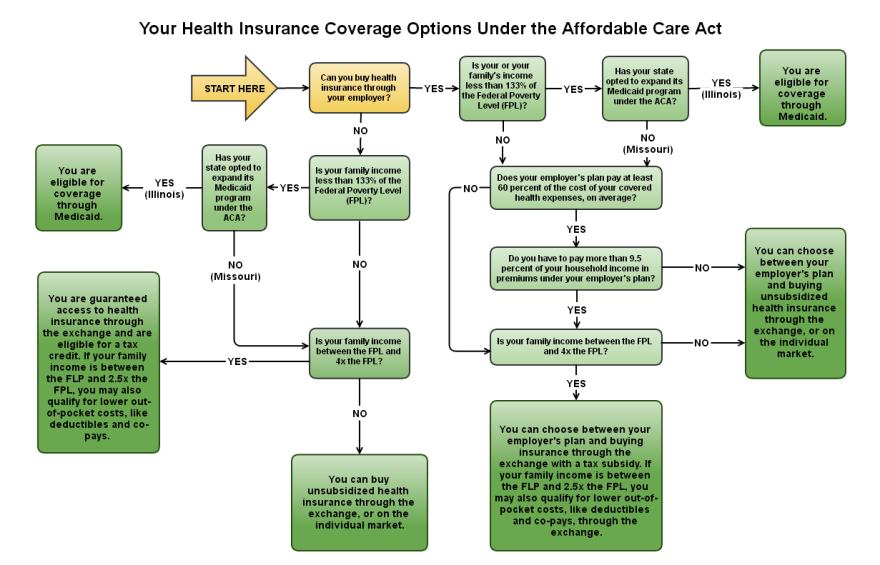

Calculate your own: Want to know whether you could qualify for a tax credit? Try this subsidy calculator, developed by the Kaiser Family Foundation. Or check out this flow chart.

Are there going to be a range of options and prices for people to choose from?

Barker: Yes. So there’s four different type of plans in the marketplace, they’re called platinum, gold, silver, and bronze. Platinum plans, you’ll pay more on a monthly basis in your premium, but you’ll pay less when you go to the doctor. And then for bronze plans those will be the lowest cost in terms of your monthly premium, but when you access healthcare services you’ll pay more of the bill.

There actually is a fifth type of plan. It’s called a catastrophic plan. It is really just major medical insurance, and then it covers a few primary care doc visits a year. That will be the cheapest of all, but you have to be younger than 30 years old to purchase that catastrophic plan.

Still have more questions? Call the federal health insurance marketplace help line at 1-800-318-2596 for individuals, or 1-800-706-7893 for small businesses.

Or try one of these resources:

- The Missouri Foundation for Health's CoverMissouri website;

- The federal healthcare.gov help pages;

- The Kaiser Family Foundation's online resources on the Affordable Care Act;

- These July, August and September Q&As from NPR's Julie Rovner.

There have been some early problems. Although small businesses can start to shop for coverage on October 1, they won't be able to buy it until November. And Spanish-speakers will have to wait at least a few weeks for Spanish-language enrollment services on the healthcare.gov site.

And beware of scammers posing as government or health care workers in order to con you out of money or confidential personal information while pretending to help enroll you in the marketplace.

Follow Véronique LaCapra on Twitter: @KWMUScience