Thousands of Missourians could receive their income tax refunds late in 2018, if past years are any indication. Based on the Department of Revenue’s current interpretation of state law, taxpayers will receive little if any interest on the delayed payments.

And Missourians have been waiting longer for their refunds each year, according to report by state Auditor Nicole Galloway.

Galloway has blamed the delays on Gov. Eric Greitens and on the state’s general revenue cash balance, which was at negative $86 million last year.

Her office released an audit stating that “current state laws are unfair to taxpayers,” and that one of the Department of Revenue’s practices doesn’t follow state law.

Here’s a look at the numbers behind that claim. The data in these charts comes from the state auditor’s report. Many numbers Galloway’s office provided were estimates.

By the auditor’s approximation, more than one in four taxpayers received their tax refunds after 45 days in fiscal year 2016. (After that legal limit, the payment is officially “late” and interest begins to accrue.)

Data was not available for 2017, but the rate of late payments “is expected to be higher,” according to the report.

The audit report charts Missouri’s strategy for minimizing interest: State revenue officials issue larger refunds first. “The result is longer delays for taxpayers receiving smaller dollar refunds,” said the report.

In 2016 and 2017, individual taxpayers received much more total interest money than corporate taxpayers.

On average, the state paid individuals $3.69 in interest on late refunds in 2016 and $2.73 in 2017. More than 400,000 taxpayers in 2017 received that reimbursement after waiting until June for a refund.

The Department of Revenue’s interpretation of state law requires payment on late refunds only after that interest exceeds $1. That means that taxpayers with smaller refunds could wait more than a year for a refund, but never receive any interest payment.

According to the audit report, that part of the Department of Revenue’s interest procedure is “not consistent with state law.” The department only pays interest on funds that exceed $1 based on its interpretation of a state statute. The auditor’s report notes that state revenue officials have not converted their interpretation into a rule, as required by law.

As a consequence of this practice, the auditor’s office calculated that about $116,000 of interest accrued in 2016, but was never paid to taxpayers because it didn’t exceed $1.

$116,000: Estimated amount of interest accrued in 2016, but was never paid to taxpayers because it didn’t exceed $1

$29,000: Estimated amount of interest "erroneously" not paid

State revenue officials “erroneously” failed to pay another $29,000 to taxpayers. The error occurred when Department of Revenue did not update its computerized tax system to reflect a law change made in 2015 that decreased the refund timeline from 90 days to 45 days.

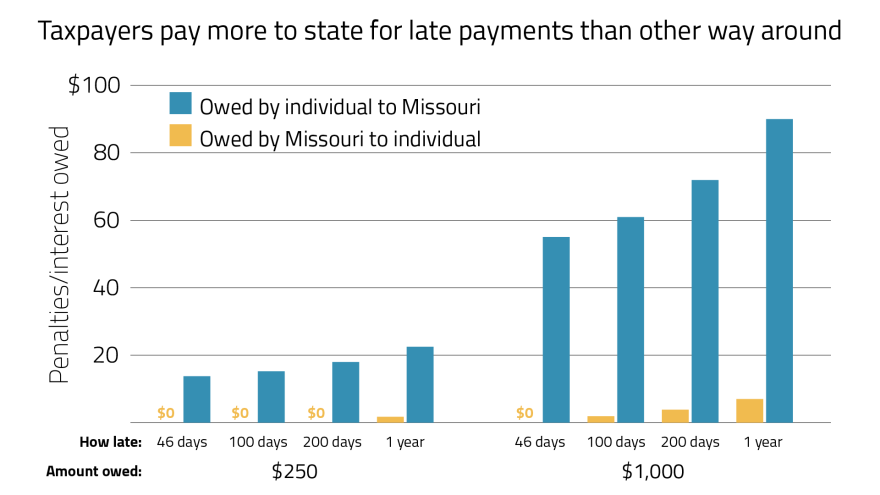

Missourians who pay their taxes late are assessed interest rates more than four times higher than the state pays taxpayers for late refunds. Late filers also may owe additional penalties.

Follow Kae Petrin on Twitter: @kmaepetrin